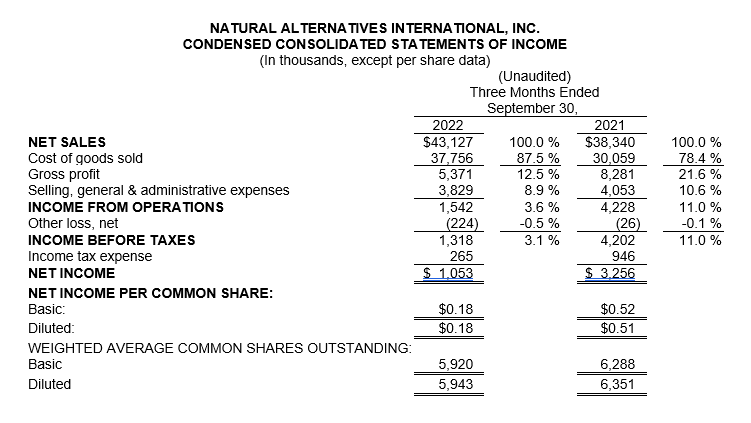

CARLSBAD, Calif., Nov. 9, 2022 /PRNewswire/ — Natural Alternatives International, Inc. (“NAI”) (Nasdaq: NAII), a leading formulator, manufacturer, and marketer of customized nutritional supplements, today announced net income of $1.1 million, or $0.18 per diluted share, on net sales of $43.1 million for the first quarter of fiscal year 2023 compared to net income of $3.3 million, or $0.51 per diluted share, in the first quarter of the prior fiscal year.

Net sales during the three months ended September 30, 2022 increased $4.8 million, or 12.5%, to $43.1 million as compared to $38.3 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales increased $8.2 million, a 24.4% increase from the comparable quarter last year. Private-label contract manufacturing sales increased primarily due to higher sales to our two largest customers, partially offset by decreased sales to other smaller customers and lower average exchange rates applied to sales denominated in Euro as compared to the prior year period. Our foreign exchange rates as applied to sales denominated in Euro decreased to a weighted average of 1.12 EUR/USD in the first three months of fiscal 2023 compared to a weighted average of 1.18 EUR/USD during the first three months of fiscal 2022. Sales backlog for the quarter ended September 30, 2022, totaled approximately $8.0 million primarily related to supply chain and logistical constraints.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue decreased 71.5% to $1.4 million during the first quarter of fiscal year 2023, as compared to $4.7 million for the first quarter of fiscal year 2022. The decrease in patent and trademark licensing revenue during the first quarter of fiscal 2022 was primarily due to a decrease in orders from existing customers as a result of market and inflationary factors along with a general slowdown in the Sports Nutrition sales channel. Included in the market factors is the fact that the first three months of fiscal 2022 benefited from a ramp up of Sports Nutrition sales activity due to easing COVID restrictions on athletic activities with no corresponding activity in the first three months of fiscal 2023.

Based on our current sales order volumes and forecasts we have received from our customers, we now anticipate our fiscal 2023 consolidated net sales will be slightly up as compared to fiscal 2022. While sales are expected to increase during fiscal 2023 when compared to fiscal 2022, we anticipate operating income will be negatively impacted by changes in sales mix, unfavorable foreign exchange rates, and inflationary factors including increased operational costs impacted by increased labor, raw material, freight and supply chain costs. We are working with both suppliers and customers to attempt to mitigate the expected negative impact on our fiscal 2023 financial results. There can be no assurances our expectations will result in the currently anticipated increase in net sales and expected operating income levels.

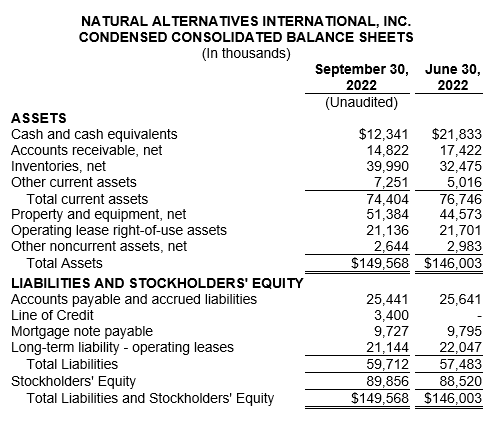

As of September 30, 2022, we had cash of $12.3 million and working capital of $47.6 million compared to $21.8 million and $53.5 million respectively, as of June 30, 2022. As of September 30, 2022, we owed $3.4 million and had $16.6 million available under our line of credit agreement.

Mark A. Le Doux, Chairman and Chief Executive Officer of NAI stated, “Despite persistent economic headwinds, we are encouraged by the growth in our contract manufacturing sales. However, the continued impact of inflation has and will continue to have a negative impact on our net financial results. We are actively evaluating a variety of cost savings programs in order to preserve margins as much as possible, but these challenges are likely to persist into the near future.”

“Much like many other industries, we believe the dietary supplement industry has entered a period of constrained growth due to the effect inflation is having on consumer behaviors. This inflationary impact appears to have affected the Sports Nutrition Industry most significantly, but there are indications that other areas of the dietary supplement industry are experiencing the same economic pressures. We believe we have a strong core business and this foundation coupled with the strength of our balance sheet will help us weather this economic storm.”

“Construction on our new powder manufacturing facility in Carlsbad, California continues to progress, and we still anticipate this state-of-the art powder plant will be operational by the middle of our fiscal year 2023.”

“We remain committed to delivering value for our shareholders as we repurchased 46,795 shares of our common stock in the first quarter of fiscal 2023 and intend to continue to opportunistically buy back shares in the future. While we see macro challenges across the economy ahead, our team is working hard across all departments to navigate these obstacles, deliver superior service for our customers and drive sales growth and profitability.”

An updated investor presentation will be posted to the investor relations page on our website later today (https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at http://nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, our ability to develop, maintain or increase sales to new and existing customers, our ability to attract and retain sufficient labor, COVID-19 and related impacts on the availability of raw materials, our future revenue profits and financial condition, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: https://www.nai-online.com