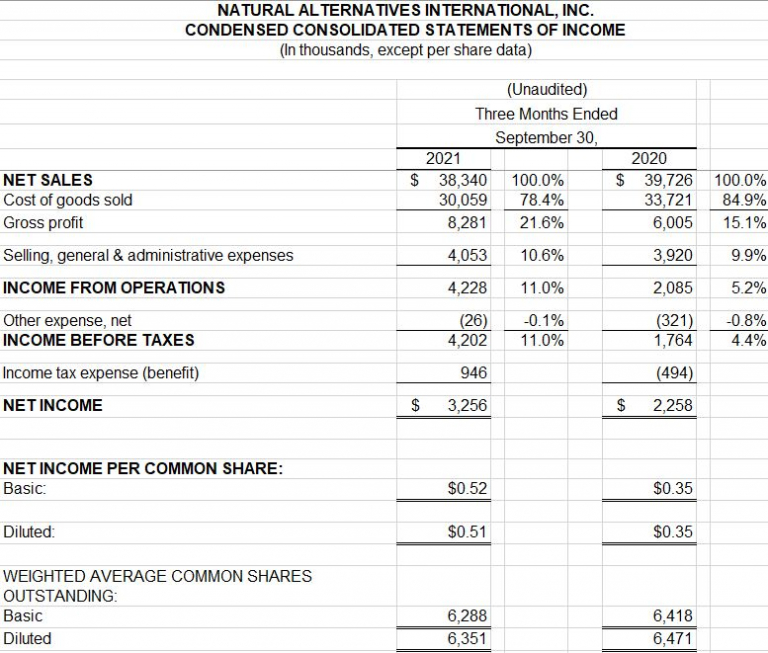

- 2022 Q1: $38.3 million Net Sales, $3.3 million Net Income, $0.51 diluted EPS

CARLSBAD, CALIF, November 9, 2021 /PRNewswire/ –Natural Alternatives International, Inc. (“NAI”) (Nasdaq: NAII), a leading formulator, manufacturer, and marketer of customized nutritional supplements, today announced net income of $3.3 million, or $0.51 per diluted share, on net sales of $38.3 million for the first quarter of fiscal year 2022 compared to net income of $2.3 million, or $0.35 per diluted share, in the first quarter of the prior fiscal year.

Net sales during the three months ended September 30, 2021 decreased $1.4 million, or 3.5%, to $38.3 million as compared to $39.7 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales decreased to $33.6 million, a 9.3% decrease from the comparable quarter last year. Private-label contract manufacturing sales decreased primarily due to a 45% decrease in sales to our largest customer primarily associated with their European markets. This sales decline was largely offset by increased sales to new and existing customers including significant sales from a new customer operating in the direct-to-consumer marketplace. Sales backlog for the quarter ended September 30, 2021 exceeded $8.0 million and was primarily related to supply chain and logistical constraints.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue increased 77.1% to $4.7 million during the first quarter of fiscal year 2022, as compared to $2.7 million for the first quarter of fiscal year 2021. The increase in patent and trademark licensing revenue during the first quarter of fiscal 2022 was primarily due to increased shipments to existing customers related to athletic activities and gyms reopening in accordance with easing COVID-19 restrictions across the USA as compared to significant restrictions in athletic activities in the first quarter of fiscal 2021 combined with sales to new customers and higher average sales prices.

Based on our current sales order volumes, backlog and forecasts we have received from our customers; we now anticipate our fiscal year 2022 consolidated net sales will increase between 7.0% and 10.0% as compared to fiscal year 2021. We also now anticipate we will generate operating income between 10.0% and 13.0% of net sales for our fiscal year ending June 30, 2022. Sales and profitability during the first half of fiscal 2022 are anticipated to decline when compared to the same period of fiscal 2021. Our expectations for the first half of fiscal 2022 are being driven by continuing supply chain, labor, and logistical constraints, all of which are expected to result in a backlog of existing orders that may not be fully cleared until the second half of fiscal 2022. We currently anticipate these supply chain and manufacturing challenges will mostly resolve themselves during the second half of fiscal 2022. As a result, we expect sales and profitability in the second half of fiscal 2022 to exceed the comparable period in fiscal 2021, with the overall fiscal 2022 results reflecting an increase in both sales and profitability on a full year basis.

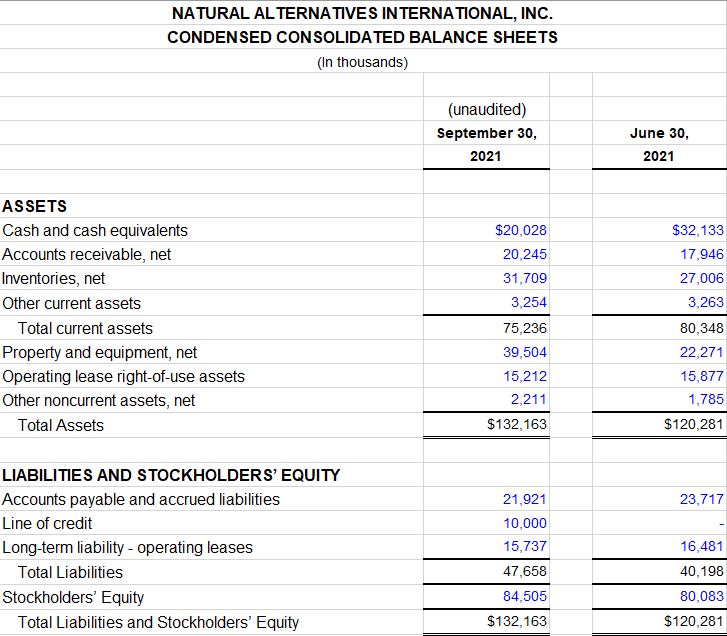

As of September 30, 2021, we had cash of $20.0 million and working capital of $54.6 million compared to $32.1 million and $58.3 million respectively, as of June 30, 2021. As of September 30, 2021, we had $20.0 million available under our line of credit agreement.

Mark A. Le Doux, Chairman and Chief Executive Officer of NAI stated, “Despite a decline in sales from our largest customer, we have been able to make significant progress in growing our business with other customers in a variety of channels, including the recent acquisition of a new direct to consumer based customer we expect will help drive significant future growth for our company. We believe the dietary supplement industry is in a period of meaningful growth, and we find ourselves in the enviable position where we are able to capitalize on new opportunities leveraging our reputation of quality and integrity along with our available equipment capacity supported by the strength of our balance sheet.”

“We continue to navigate challenges related to supply chain and staffing that have resulted in larger than normal backlog, but we believe we will be able to overcome these challenges by the end of this calendar year. Our investments related to securing adequate supplies of inventory and labor are expected to pay dividends in the second half of our current fiscal year.”

“We believe our favorable profitability as a percentage of sales is a trend that will be fully realized on a full year basis supported by improved customer mix, capacity utilization, favorable currency translation on foreign sales, and improved contribution from our CarnoSyn® business.”

An updated investor presentation will be posted to the investor relations page on our website later today (https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at http://nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, our ability to develop, maintain or increase sales to new and existing customers, our ability to attract and retain sufficient labor, COVID-19 and related impacts on the availability of raw materials, our future revenue profits and financial condition, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

SOURCE – Natural Alternatives International, Inc.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: https://www.nai-online.com