Record Level of Sales, Net Income, and Diluted EPS for the First Nine Months

- 2021 Q3: $46.3 million Net Sales (+81.8%), $1.9 million Net Income, $0.30 diluted EPS

- Updates Fiscal Year 2021 Outlook: 45%-55% Net Sales Increase

- Liquidity, Working Capital Position and Sales Backlog Continue to Remain Strong

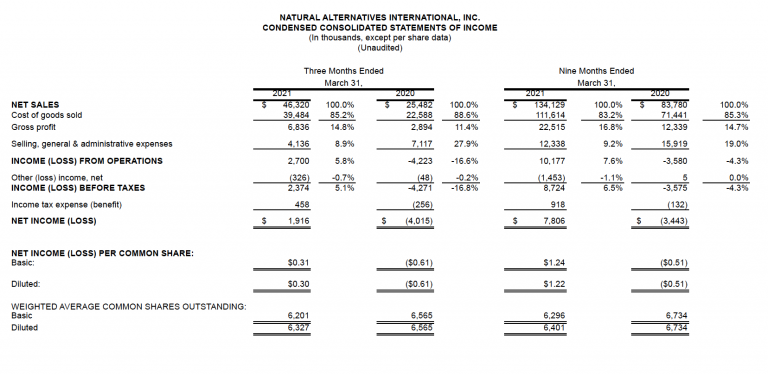

CARLSBAD, CALIF, May 13, 2021 /PRNewswire/ –Natural Alternatives International, Inc. (“NAI”) (Nasdaq: NAII), a leading formulator, manufacturer and marketer of customized nutritional supplements, today announced net income of $1.9 million, or $0.30 per diluted share, on net sales of $46.3 million for the third quarter of fiscal year 2021 compared to a net loss of $4.0 million, or $0.61 per diluted share, in the third quarter of the prior fiscal year. Our results for the third quarter of fiscal 2020 included the negative impact of a $4.3 million accounts receivable and inventory reserve related to a former customer, which was not repeated in the third quarter of fiscal 2021.

Net sales during the three months ended March 31, 2021 increased $20.8 million, or 81.8%, from $25.5 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales increased $19.5 million, or 86.2%, from the comparable quarter last year. Private-label contract manufacturing sales increased for a majority of our distribution channels worldwide primarily due to increased shipments of existing products and sales of newly awarded products to new and existing customers. CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue increased 45.6% to $4.1 million during the third quarter of fiscal 2021, as compared to $2.8 million for the third quarter of fiscal 2020. CarnoSyn® sales increased primarily due to an increase in material shipments resulting from higher sales to existing customers and the increase in athletic activities as gyms and athletic facilities began to reopen in accordance with easing COVID-19 guidelines for various cities and states across the USA.

Net income for the nine months ended March 31, 2021 was $7.8 million, or $1.22 per diluted share, compared to a net loss of $3.4 million, or $0.51 per diluted share, for the nine months ended March 31, 2020.

Net sales during the nine months ended March 31, 2021 increased $50.3 million, or 60.1%, from $83.8 million recorded in the comparable prior year period. For the nine months ended March 31, 2021, private-label contract manufacturing sales increased $51.1 million, or 69.5%, from the comparable period last year. CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue decreased 7.1% to $9.6 million during the first nine months of fiscal 2021, as compared to $10.3 million for first nine months of fiscal 2020.

Based on our current sales order volumes and future period sales forecasts received from our customers, we now expect our annualized fiscal 2021 net sales to increase between 45% and 55% compared to fiscal 2020. We also expect to generate operating income between 7% and 9% of net sales for our fiscal year ending June 30, 2021.

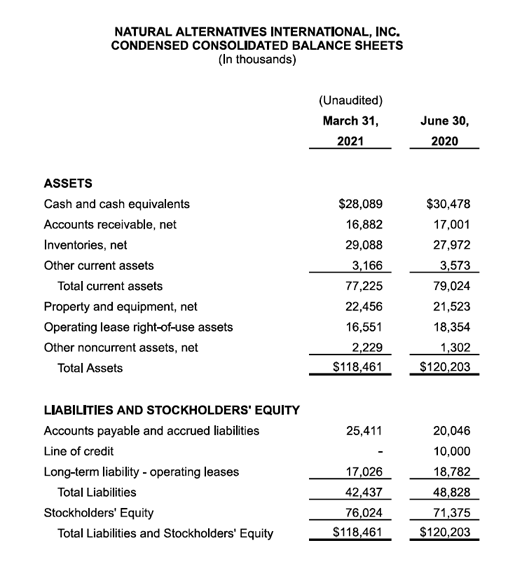

As of March 31, 2021, we had cash of $28.1 million and working capital of $53.8 million compared to $30.5 million and $51.2 million, respectively, as of June 30, 2020. As of March 31, 2021, we had $10.0 million available under our line of credit agreement.

Mark A. Le Doux, Chairman and Chief Executive Officer of NAI stated, “Sales and profitability for the first nine months of this fiscal year represent a new record for our company. Additionally, we continue to maintain a significant pipeline of orders for delivery in the coming months, and as a result have modified our outlook for the remainder of the year. While maintaining an enviable balance sheet, we are also seizing opportunities as presented to secure inventories for our future needs. This has been challenging for a variety of logistical concerns as issues with COVID-19 management have impacted supply-chains around the world. Nevertheless, we are planning for a robust future as it is clear to us that consumer trends involving making healthier choices will continue to be an enduring dividend from the difficulties of the past year.”

“The dietary supplement industry continues to report robust demand for product and we are in line with that industry trend. We think this supports our belief this trend will continue and is not just a temporary effect of the COVID-19 pandemic.”

“We continue to seek additional growth opportunities both organic and strategic and we believe we are well positioned to take advantage of such opportunities based on our strong working capital position, available capacity, and stellar reputation for excellence within our industry. NAI is the first and currently only company in our industry to be audited and certified by the Supplement Safety Compliance Initiative (SSCI), a retailer led initiative to bolster supply chain and consumer confidence for their member’s nutritional supplement products. The implications for this certification are immense given that major retailers, both in brick and mortar as well as online are increasingly requiring this type of certification to permit products to be sold through their channels.”

An updated investor presentation will be posted to the investor relations page on our website later today (https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at https://www.nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, the impact of COVID-19, our future revenue profits and financial condition, our ability to maintain our patents, generate revenues from the commercialization of our patents and trademarks, secure compliance with our intellectual property rights, and develop, maintain or increase sales to new and existing customers, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers that these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

SOURCE – Natural Alternatives International, Inc.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: https://www.nai-online.com