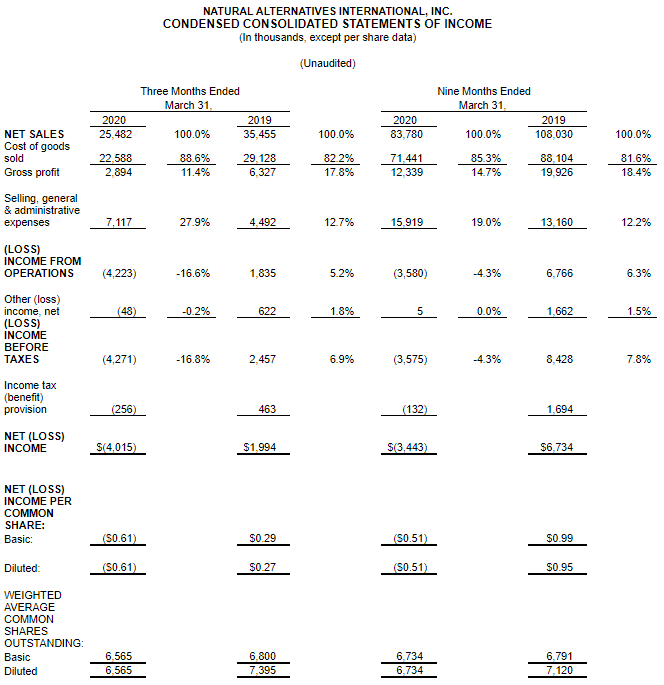

CARLSBAD, Calif., May 14, 2020 /PRNewswire/ — Natural Alternatives International, Inc. (“NAI”) (Nasdaq: NAII), a leading formulator, manufacturer and marketer of customized nutritional supplements, today announced a net loss of $4.0 million, or $0.61 per diluted share, for the quarter ended March 31, 2020.

Net sales during the three months ended March 31, 2020 decreased $10.0 million, or 28.1%, from $35.5 million recorded in the comparable prior year period. During the same period, private-label contract manufacturing sales decreased $9.1 million, or 28.7%, from the comparable quarter last year. Third quarter contract manufacturing sales decreased primarily due to lower sales to our largest contract manufacturing customer.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue decreased 23.3% to $2.8 million during the third quarter of fiscal 2020, as compared to $3.7 million for the third quarter of fiscal 2019.

We recorded a net loss of $4.0 million, or $0.61 per diluted share, for the three months ended March 31, 2020 as compared to net income of $2.0 million, or $0.27 per diluted share in the third quarter of fiscal 2019. Our results for the third quarter of fiscal 2020 were negatively impacted by a non-cash $4.3 million accounts receivable and inventory reserve related to a former customer.

Net sales during the nine months ended March 31, 2020 decreased $24.3 million, or 22.4%, from $108.0 million recorded in the comparable prior year period. For the nine months ended March 31, 2020, private-label contract manufacturing sales decreased $21.0 million, or 22.2%, from the comparable period last year. Sales to our largest customer declined $22.3 million or 38.3% for the nine months ended March 31, 2020. This sales decline was partially offset by increased sales to other new and existing customers.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue during the nine months ended March 31, 2020 decreased $3.2 million, or 23.9%, from $13.5 million during the comparable period last year. We believe this decline was impacted by certain customers discontinuing the use of our CarnoSyn® beta-alanine in favor of generic beta-alanine and lower overall consumer demand for our customers’ CarnoSyn® products. These sales declines were further compounded by the challenges to point of sale transactions with many locations effectively closed due to ‘stay-at-home’ orders imposed by various governors starting in mid-March 2020.

Net loss for the nine months ended March 31, 2020 was $3.4 million, or $0.51 per diluted share, compared to net income of $6.7 million, or $0.95 per diluted share, for the nine months ended March 31, 2019.

On March 11, 2020, the World Health Organization classified the novel coronavirus, or COVID-19, as a pandemic. The COVID-19 pandemic has resulted, and is likely to continue to result, in significant economic disruption and has and will likely affect our business. To date, the Company’s facilities, located both in the United States and Europe continue to operate as an essential and critical manufacturer in accordance with federal, state, and local regulations.

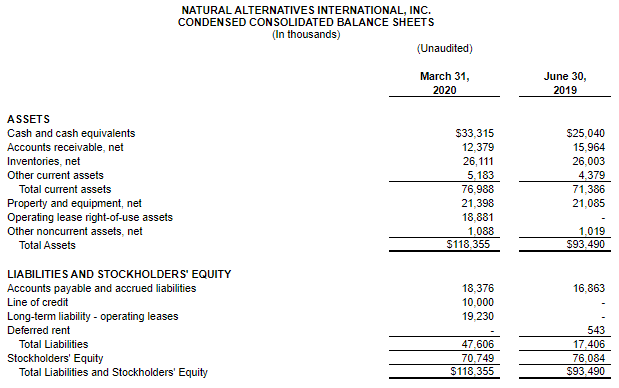

As a measure to provide our business with added liquidity, and out of an abundance of caution, we withdrew $10.0 million from our credit facility with Wells Fargo Bank. We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state or local authorities or that we determine are in the best interests of our employees, customers, suppliers and shareholders. While we are unable to determine or predict the nature, duration, or scope of the overall impact the COVID-19 pandemic will have on our business, results of operations, liquidity or capital resources, we believe we will be able to remain operational and that our working capital will be sufficient for us to remain operational as the longer term consequences of this pandemic become known.

As of March 31, 2020, NAI had cash of $33.3 million and working capital of $51.2 million compared to $25.0 million and $57.1 million, respectively, as of June 30, 2019. As of March 31, 2020, we did not have any remaining availability under our credit facilities.

Mark A. LeDoux, Chairman and Chief Executive Officer of NAI stated, “The third quarter brought several unforeseen challenges, including the loss of a former customer and the COVID-19 global pandemic. While the loss of a former customer negatively impacted our results and the future remains unknown due to COVID-19, our balance sheet remains strong and we remain focused on growing our business.”

“Several components of the retail marketplace have been significantly impacted by the closure of gyms and challenges within other points of retail commerce for sports nutrition products. This reality brought on by multiple stay-at-home orders and a surge in unemployment claims has had a negative impact on sales of sports nutrition products including CarnoSyn®, and it is unclear at this time when this will change. At the same time, several of our contract manufacturing customers are experiencing various levels of sales improvements related to their health and immune support product offerings.”

“We remain encouraged at emerging signs of demand improvement from our current and new customers as evidenced by our improving backlog of contract manufacturing orders.”

“I’m extremely proud of how our US and European management teams have navigated through this ongoing global crisis and we remain committed to offering the highest level of service and quality to our customers.”

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including: scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at http://nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, the impact of COVID-19 and our ability to remain operational, our future revenue profits and financial condition, our ability to introduce products in new sales channels, maintain our patents, generate revenues from the commercialization of our patents and trademarks, secure compliance with our intellectual property rights, and develop, maintain or increase sales to new and existing customers, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers that these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: http://nai-online.com