– Q2 fiscal 2019 Net Sales increase 8% – Pre-Tax Income increases 11%

– YTD fiscal 2019 Net Sales increase 18% – Pre-Tax Income increases 33%

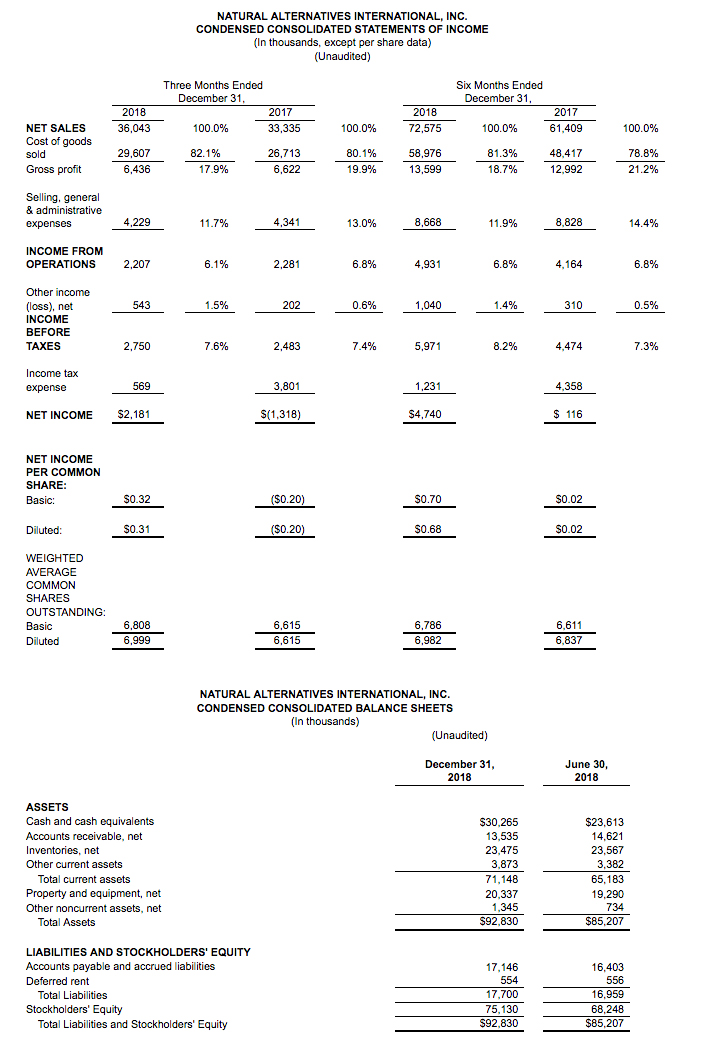

CARLSBAD, Calif., Feb. 12, 2019 /PRNewswire/ — Natural Alternatives International, Inc. (“NAI”) (Nasdaq: NAII), a leading formulator, manufacturer and marketer of customized nutritional supplements, today announced net income of $2.2 million, or $0.31 per diluted share, on net sales of $36.0 million for the quarter ended December 31, 2018.

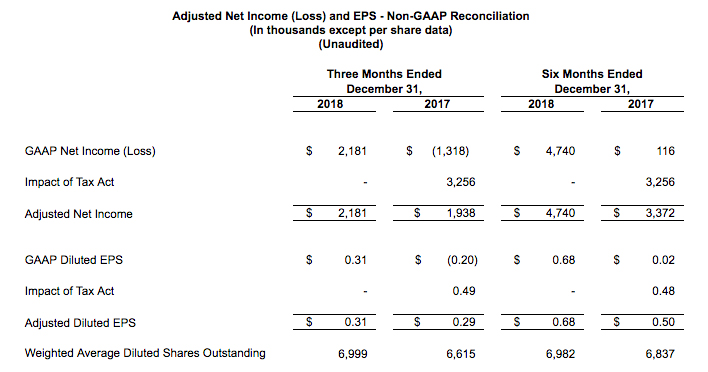

Net income for our second quarter of fiscal 2019 was $2.2 million, or $0.31 per diluted share, compared to a net loss of $1.3 million, or ($0.20) per diluted share, in the second quarter of fiscal 2018. Excluding second quarter 2018 discrete tax items, our adjusted net income was $1.9 million, or $0.29 per diluted share. The second quarter of fiscal 2018 results were unfavorably impacted by one-time discrete tax expense amounts recorded in connection with the Tax Cuts and Jobs Act (the “Tax Act”). These one-time charges totaled $3.3 million, or approximately $0.49 per diluted share.

Net sales during the three months ended December 31, 2018 increased $2.7 million, or 8.1%, from $33.3 million recorded in the comparable prior year period. For the quarter ended December 31, 2018, private label contract manufacturing sales increased $2.3 million, or 7.9%, from the comparable quarter last year. Second quarter contract manufacturing sales increased primarily due to the sale of new products to new and existing customers and higher volumes of current products to existing customers.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue increased 10.1% to $4.4 million during the second quarter of fiscal 2019, as compared to $4.0 million for the second quarter of fiscal 2018. The increase in CarnoSyn® revenue was primarily due to higher sales volumes to existing customers partially offset by lower average material sales prices.

Net income for the six months ended December 31, 2018 was $4.7 million, or $0.68 per diluted share, compared to net income of $0.1 million, or $0.02 per diluted share, for the six months ended December 31, 2017. Excluding discrete tax items, our adjusted net income during the six months ended December 31, 2017 was $3.4 million, or $0.50 per diluted share. The previous period’s results were unfavorably impacted by one-time discrete tax expense amounts recorded in connection with the Tax Act. These one-time charges totaled $3.3 million, or approximately $0.48 per diluted share.

Net sales during the six months ended December 31, 2018 increased $11.2 million, or 18.2%, from $61.4 million recorded in the comparable prior year period. For the six months ended December 31, 2018, private label contract manufacturing sales increased $11.2 million, or 21.7%, from the comparable period last year. Second quarter contract manufacturing sales increased primarily due to the sale of new products to new and existing customers and higher volumes of current products to existing customers.

CarnoSyn® beta-alanine royalty, licensing and raw material sales revenue during the first six months of fiscal 2019 were $9.8 million which was consistent with the first six months of fiscal 2018.

As of December 31, 2018, we had cash of $30.3 million and working capital of $56.5 million compared to $23.6 million and $50.9 million, respectively, as of June 30, 2018. As of December 31, 2018, we had $10.0 million available under our line of credit agreement.

Mark A. LeDoux, Chairman and Chief Executive Officer stated, “We continue to see market expansion for our products, both in the CarnoSyn® arena and in contract manufacturing. With our commitment to quality and dedication to exceeding our customers’ expectations, the continued course of action remains bright. Due to increased demands in different markets, we are continuing to expand our manufacturing capabilities in Switzerland, while simultaneously updating operational efficiencies in our California facilities.”

“I am very grateful to the NAI team members who demonstrate excellence in their everyday efforts, as exemplified by these financial results. As we endeavor to grow our existing business we continue to evaluate potential opportunities for accretive transactions that could further expand our footprint in this exciting industry, while continuing to invest in the scientific research and regulatory compliance efforts which have set us apart from others unable or unwilling to do so.”

Reconciliation of Non-GAAP Information

The GAAP results contained in this press release and the financial statement schedules attached to this press release have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). In addition to the Company’s results prepared in accordance with GAAP, the Company provided information on a non-GAAP basis. The manner in which this non-GAAP information is derived is discussed below, and the Company has provided in the tables to this release a reconciliation of the non-GAAP information to the most directly comparable GAAP information.

Net Income (Loss) and EPS Adjusted for Non-Recurring Tax Expense. In order to make the fiscal year 2017 results comparable to fiscal year 2018, we have presented net income and EPS for the three and six months ended December 31, 2017 on a non-GAAP basis by excluding discrete tax items of $3.3 million related to the Tax Act for both the three and six month periods. The following is schedule reconciling our Adjusted Net Income (Loss) and EPS to our GAAP Net Income (Loss) and EPS.

NAI, headquartered in Carlsbad, California, is a leading formulator, manufacturer and marketer of nutritional supplements and provides strategic partnering services to its customers. Our comprehensive partnership approach offers a wide range of innovative nutritional products and services to our clients including: scientific research, clinical studies, proprietary ingredients, customer-specific nutritional product formulation, product testing and evaluation, marketing management and support, packaging and delivery system design, regulatory review and international product registration assistance. For more information about NAI, please see our website at http://nai-online.com.

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 that are not historical facts and information. These statements represent our intentions, expectations and beliefs concerning future events, including, among other things, future acquisitions, revenue profits and financial condition, our ability to maintain our patents, generate revenues from the commercialization of our patents and trademarks, secure compliance with our intellectual property rights, and develop, maintain or increase sales to new and existing customers, as well as future economic conditions and the impact of such conditions on our business. We wish to caution readers that these statements involve risks and uncertainties that could cause actual results and outcomes for future periods to differ materially from any forward-looking statement or views expressed herein. NAI’s financial performance and the forward-looking statements contained herein are further qualified by other risks, including those set forth from time to time in the documents filed by us with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K.

CONTACT – Michael Fortin, Chief Financial Officer, Natural Alternatives International, Inc., at 760-736-7700 or [email protected].

Web site: http://nai-online.com

Cision View original content:http://www.prnewswire.com/news-releases/natural-alternatives-international-inc-announces-2019-q2-and-ytd-results-300794351.html

SOURCE Natural Alternatives International, Inc.